Insurance is an essential tool for safeguarding your financial future. Whether it’s health, home, auto, or life insurance, these policies provide crucial protection against the unexpected. However, many people make mistakes when purchasing or managing their insurance that can result in unnecessary financial strain. Here are the top 5 insurance mistakes you should avoid to ensure you’re adequately protected and not overpaying for coverage.

1. Underestimating the Importance of Adequate Coverage

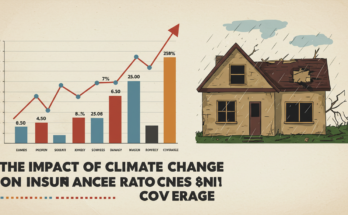

One of the most common insurance mistakes people make is not having enough coverage. While it might seem tempting to save money by opting for a basic or cheaper policy, this can leave you vulnerable when disaster strikes.

For instance, with homeowners insurance, choosing minimal coverage could mean you won’t have enough funds to fully repair or replace your home and belongings if something catastrophic happens. Similarly, inadequate health insurance can lead to massive out-of-pocket expenses for hospital bills, medications, and treatments that are not covered under a basic plan.

How to Avoid This Mistake:

Always assess your needs carefully and choose coverage that provides adequate protection based on your lifestyle, assets, and risk exposure. It’s important to ask yourself: “What would happen if this were to happen to me?” Make sure your coverage reflects the potential costs you could face.

2. Failing to Review and Update Your Policies Regularly

Your life, assets, and circumstances change over time, and so should your insurance. A policy that was sufficient when you first bought it might not meet your needs a few years down the line. Many people neglect to review and update their insurance policies after significant life events, such as buying a new car, getting married, or having children.

For example, if you acquire a new home or expensive valuables, like electronics or artwork, and don’t update your homeowners insurance, your existing policy might not fully cover them in the event of theft, fire, or damage.

How to Avoid This Mistake:

Regularly review your policies—at least once a year—and after major life changes. Ensure that your coverage aligns with your current needs and that your deductibles and limits are in line with the value of your possessions or responsibilities.

3. Not Shopping Around for the Best Deals

Insurance is a competitive market, and prices can vary significantly between providers. Yet, many people stick with the same insurer year after year, assuming that their policy is the best deal without comparing other options. This is a mistake that can cost you money in the long run.

Providers often offer discounts, special deals, or lower premiums to attract new customers, and rates can change as you age or your risk profile shifts. Failing to shop around means you might be overpaying for coverage that doesn’t offer the best value.

How to Avoid This Mistake:

Don’t hesitate to get quotes from multiple insurers when renewing your policies. Use comparison websites or consult with an insurance broker to explore your options. A little effort in comparing can lead to substantial savings without sacrificing the quality of coverage.

4. Ignoring the Fine Print

Insurance policies are full of terms, conditions, and exclusions that may not be immediately obvious. Many policyholders fail to read the fine print, assuming that everything is covered when, in fact, there are specific exclusions that could leave them unprotected in certain situations.

For example, a car insurance policy might cover accidents but exclude certain types of natural disasters or events, such as floods. Similarly, health insurance policies might exclude certain treatments or have strict limitations on mental health care or specialist services.

How to Avoid This Mistake:

Always read and understand the details of your policy before signing. Pay attention to what is and isn’t covered, as well as any exclusions and limitations. If you don’t understand something, ask your insurer for clarification. This will help prevent surprises when you need to file a claim.

5. Relying Too Much on Employer-Sponsored Insurance

Many people rely solely on employer-sponsored insurance for health and life coverage, assuming it’s sufficient for all their needs. While employer-sponsored insurance can be a great benefit, it’s often not enough for comprehensive protection, especially if you have unique medical needs, dependents, or assets to protect.

In some cases, employer health insurance plans may have limited networks, restrictive coverage, or inadequate coverage for dependents, leaving you exposed to high medical bills. Additionally, if you lose your job or change employers, you might find yourself without coverage, or facing significantly higher premiums if you have to purchase insurance on your own.

How to Avoid This Mistake:

While employer-sponsored insurance can be an excellent starting point, don’t rely on it as your only form of coverage. Consider purchasing additional health insurance or life insurance independently to ensure that you are fully protected. Similarly, review your plan every year to ensure that it aligns with your current healthcare needs.

Conclusion

Insurance is a crucial part of a sound financial plan, but making these common mistakes can leave you vulnerable or paying more than necessary. To ensure you have the right coverage at the best price, take the time to assess your needs, review your policies regularly, shop around for the best deals, and read the fine print. By avoiding these pitfalls, you can maximize the protection insurance offers and avoid unnecessary stress and expenses down the road.

Remember, insurance isn’t just about having coverage—it’s about having the right coverage.