Let me tell you a story about the time I tried to outsmart my car insurance bill. Last year, after moving to a new city (hello, higher premiums), I spent a weekend buried in quote forms, determined to find the cheapest option. Friends swore by Geico’s lizard mascot, while others praised Progressive’s Snapshot program. Spoiler: My wallet didn’t care about mascots—it cared about math. Here’s what I learned, and how you can avoid my rookie mistakes.

The Price Tag Showdown: How Geico and Progressive Stack Up

Both Geico and Progressive dominate the insurance market with aggressive ads and catchy slogans. But when you strip away the marketing, which one actually offers better rates? The answer isn’t universal—it depends on your driving history, location, and even your credit score.

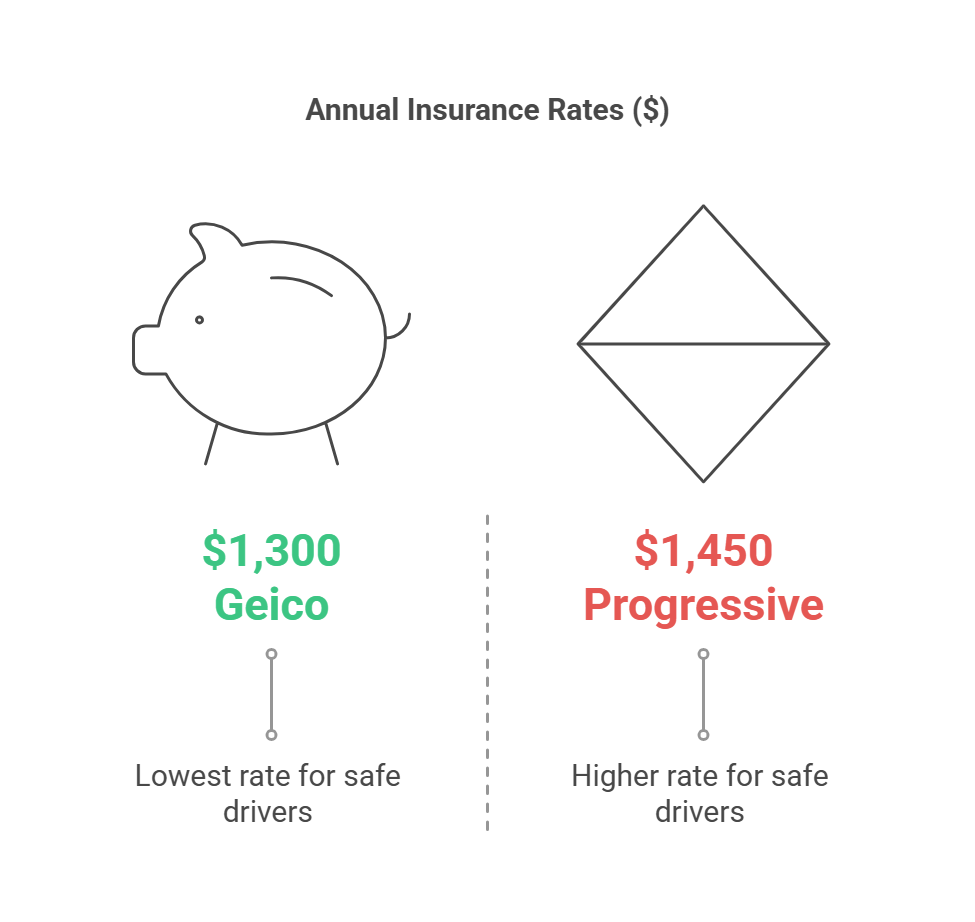

Here’s a quick breakdown of average annual rates for common driver profiles:

| Driver Profile | Geico Average Annual Rate | Progressive Average Annual Rate |

|---|---|---|

| Safe Driver (Clean Record) | $1,300 | $1,450 |

| Driver With One Accident | $1,800 | $1,700 |

| Young Driver (Under 25) | $2,500 | $2,300 |

| Urban Resident (High ZIP Code) | $2,200 | $2,100 |

Data sourced from NerdWallet’s 2023 rate analysis and Forbes’ insurance comparisons.

Geico often wins for low-risk drivers, while Progressive tends to edge ahead for those with accidents or younger motorists. But here’s the kicker: My own quote from Progressive was $200 cheaper annually than Geico’s—thanks to a clean driving record and their Snapshot discount. Which brings us to…

The Discount Game: How to Play It Right

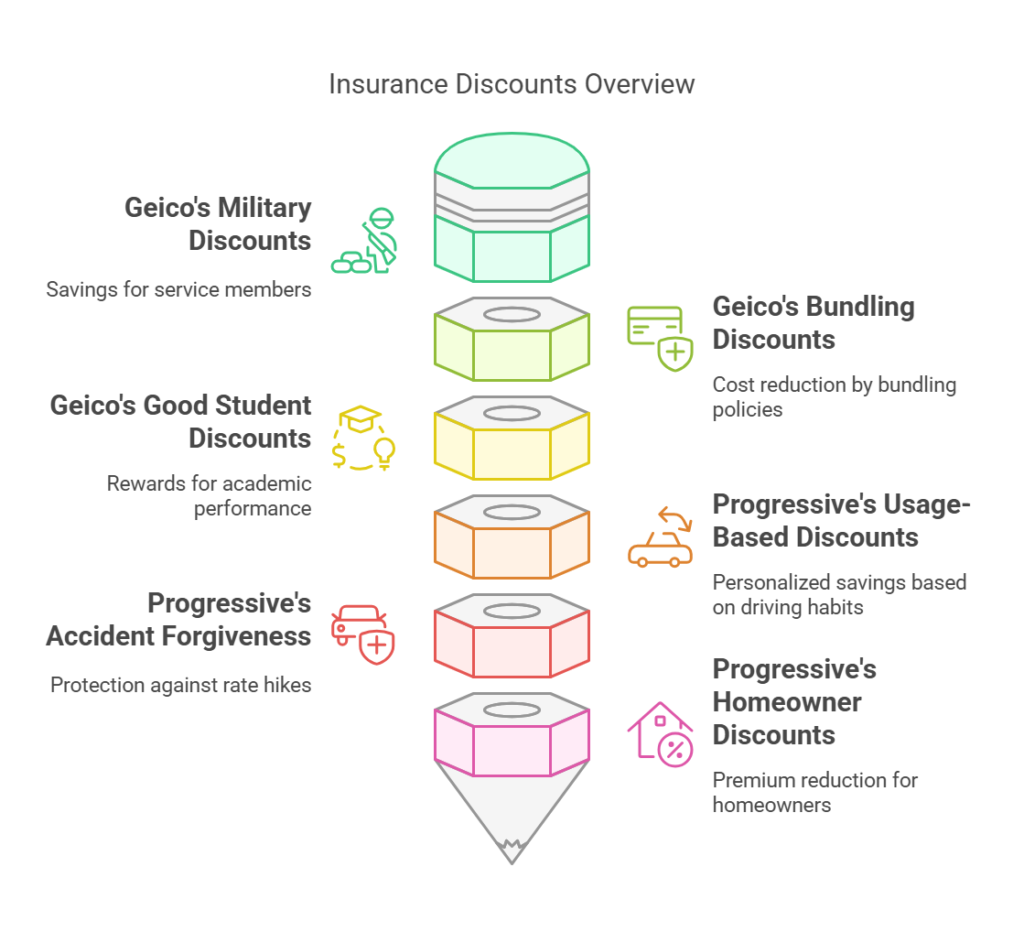

Geico’s Strengths

- Military & Federal Employee Discounts: Savings up to 15% for service members.

- Multi-Policy Bundling: Pairing auto with renters/home insurance can cut costs by 25%.

- Good Student Rewards: Full-time students with B averages save up to 15%.

Progressive’s Perks

- Usage-Based Savings: The Snapshot app tracks driving habits (think smooth stops, low mileage) for personalized discounts.

- Accident Forgiveness: Avoid rate hikes after your first at-fault accident (if eligible).

- Homeowner Discounts: Even if you don’t bundle, owning a home can trim your premium.

During my quote marathon, Progressive’s Snapshot program promised an extra 10% off, which ultimately sealed the deal. Geico’s DriveEasy program offers similar tracking, but their base rate didn’t compete.

“But Wait, What About Customer Service?”

Price isn’t everything. Claims satisfaction matters when you’re stranded after a fender bender. Here’s the scoop:

- Geico: Ranked #1 in J.D. Power’s 2023 Claims Study for hassle-free claims.

- Progressive: Praised for digital tools, like photo claims, but scores slightly lower in overall satisfaction.

I’ve filed one claim with Progressive after a parking lot scrape. The process took 48 hours, and the app made uploading photos a breeze. A friend with Geico raved about their 24/7 phone support. Your preference here depends on whether you value tech efficiency or human interaction.

The Verdict: It’s All About Your Numbers

Back to my insurance saga: I saved 200/yearwithProgressive,butmyneighborswearsGeicoundercutsthemby200/yearwithProgressive,butmyneighborswearsGeicoundercutsthemby150. There’s no one-size-fits-all answer. Your best move? Compare quotes annually. Rates shift based on market trends, life changes (like that cross-country move), and even new discounts.

Try This Pro Tip:

Use third-party tools like The Zebra to compare Geico, Progressive, and regional insurers in one shot. I did—and found a local provider that beat both giants.

Final Thoughts: Don’t Let Loyalty Cost You

Insurance companies bank on inertia. They’ll quietly hike your rate year after year, assuming you won’t shop around. My advice? Channel your inner skeptic. Spend 20 minutes every renewal period comparing quotes. And if you’re torn between Geico and Progressive, remember: The “cheaper” option is whichever company sees you as low-risk.

Got a win with Geico or Progressive? Share your story in the comments—I’ll shout out the most surprising savings hack next month.

Eien is a former insurance skeptic who now obsessively optimizes every bill. When not writing about finance, he’s probably arguing with his GPS or testing DIY car wash techniques.